Strategy

Remove operational inefficiencies, provide funds to under capitalized hotels to generate attractive ROIs and Implement intense asset management practices to ensure execution and accountability.

ADVANTAGE

Leverage extensive relationships across the ownership, management, finance and brokerage communities to identify, structure, acquire and operate attractive investment opportunities.

Maintain discipline in focusing on high ROI projects.

EXPERIENCE

Spans every hotel type from resort to urban and luxury to budget, providing best practices for every situation.

Partners have approximately 50 years of hotel/real estate experience as direct operators and financiers.

WHY HOSPITALITY?

RETURNS

Hotels are as much an operating business as a real estate investment, incorporating traditional real estate characteristics with operational complexity. Property structured and asset-managed, hotels can provide superior returns to other real estate sectors.

Location

Capital Markets

Asset Management

Expense Control

Marketing

Management

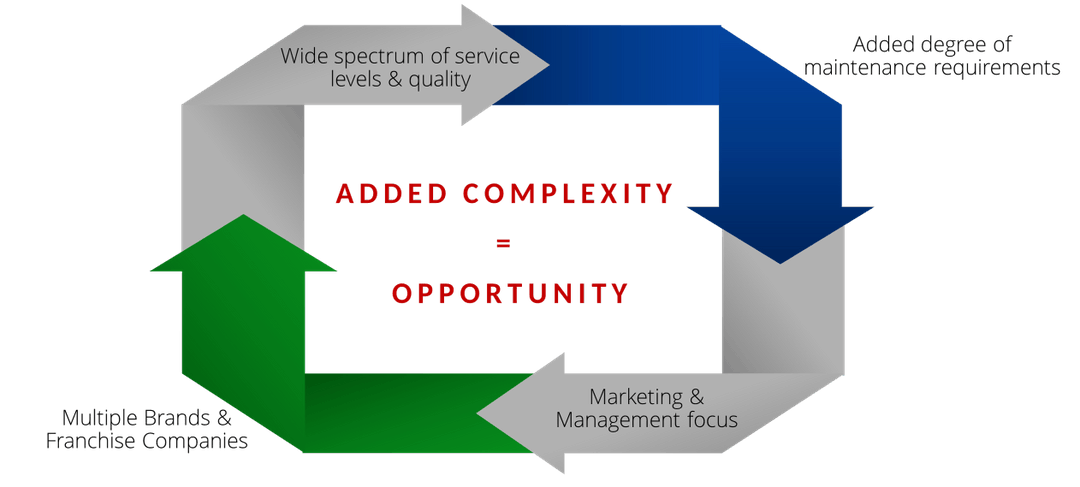

COMPLEXITY

The added complexity of hotel investments creates opportunity for savvy investors with operational expertise. RHC’s experience and passion enables it to identify and execute on these more complex situations.

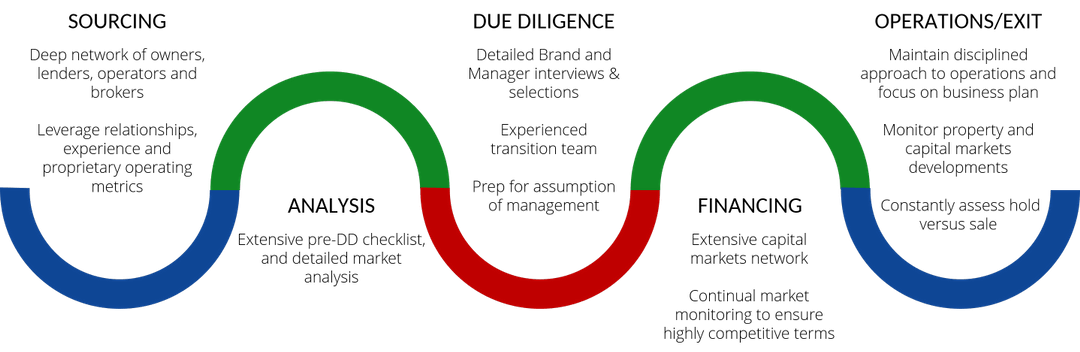

PROCESS

Reade Hotel Capital’s investment process aims to seek the best assets while reducing risk.

ASSET MANAGEMENT

GUEST SERVICE

Strong guest service drives repeat business, lowering customer acquisition costs and driving higher room rates.

Constantly monitor guest comments with focus on social media and other online outlets.

Track guest comments through brand surveys and reviews as well as online tools that “sweep” comments from sites such as TripAdvisor, Expedia, Yelp and more.

REVENUE

Focus on sales and revenue management to drive profitability.

Utilize several tools, such as Smith Travel Research (“STR”) reports, to monitor hotel top line performance against the competition .

Constantly monitor activity and relationships with Online Travel Agencies (“OTAs”) .

Methodically revisit corporate contracts to maximize profitability and drive yield.

EXPENSES

Benchmark data is obtained from national sources as well as collected through industry knowledge and expertise.

Utilize direct relationships in the industry and other hotel data sources (e.g., brokers, hotel listings, etc.) to evaluate expense margins.

Review detailed property profit and loss statements on a monthly basis, focusing on all significant expense items.

Ensure positive profit margin on virtually every expense dollar.